A partnership between accounting students from Augusta University’s James M. Hull College of Business and United Way of the CSRA is providing students with a learning opportunity outside of the classroom coupled with a chance to give back to the community. The experience has allowed the students to offer free tax preparation to eligible community members as part of the IRS Volunteer Income Tax Assistance Program.

The partnership bridges both experiential learning and community engagement. Students enrolled in ACCT4950 – Service Learning in Tax, receive hands-on training and then can put those skills to work at a local United Way VITA site.

The benefits will extend beyond tax season, as the students gain experience working with clients, developing their skills in a true tax setting and navigating the day-to-day responsibilities of servicing the public in a professional setting.

“This course is about more than just learning tax rules,” said accounting professor Sang Park, PhD. “It’s hands-on learning that also makes a real impact locally.”

Park had previously heard about campus-based VITA programs through colleagues at Cal State Northridge, one of the first schools known for having a VITA program on a university campus. Park then began to explore his own community, realizing United Way had a VITA program and needed more volunteers. That is when the idea clicked.

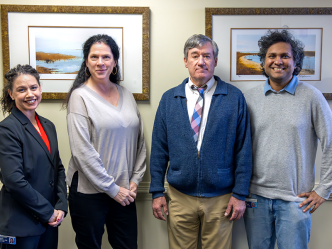

After studying many successful university-based VITA models, Park and fellow colleagues Robyn Verdery and Peter Basciano, PhD, took a trip to the University of Georgia to learn more about the program.

This semester, 20 students are enrolled in the course and have completed IRS-required certifications, including Volunteer Standards of Conduct and Intake, Interview, and Quality Review. Students can also go through simulations to help learn professional standards regarding confidentiality and quality control before having to be client-facing.

Once students obtain the certification, they can complete their service-learning hours at a United Way VITA site. For many community members, the service is critical.

“For many families, a tax return isn’t just paperwork,” Park said. “It can mean getting the right refund, claiming credits they qualify for and avoiding costly errors.”

The students have worked closely with Nadine Kendrick, program coordinator for United Way of the CSRA VITA, who emphasized how valuable the partnership has been for the program and the community.

“One of our biggest challenges in previous years has been acquiring volunteers and advocates. This partnership adds value not only to United Way and the university, but to the entire CSRA community,” Kendrick said.

For those wondering how they can help, community members can share information about the free tax services with friends or family who might qualify.

Augusta University

Augusta University