Open Enrollment occurs in the fall of each year and is your annual opportunity to change plans and/or add or drop eligible dependents. The only other opportunity you have to make changes is if you experience a qualifying life event (within 30 days).

Open Enrollment for Augusta University employees for plan year 2019 (Jan. 1, 2019-Dec. 31, 2019) will be held from Oct. 29 thru Nov. 9, 2018. Changes made during Open Enrollment will be effective Jan. 1, 2019. All employees will need to take action during benefits enrollment this year and must re-certify their tobacco status during open enrollment. This is different from past years.

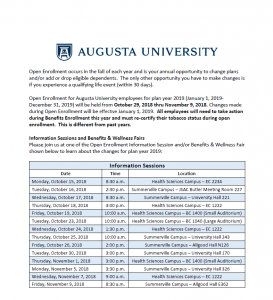

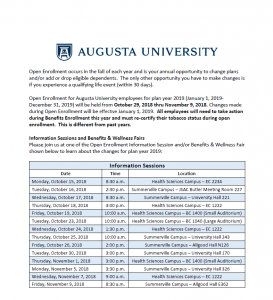

Information Sessions and Benefits & Wellness Fairs

Please join us at one of the Open Enrollment Information Session and/or Benefits & Wellness Fair shown below to learn about the changes for plan year 2019:

Information Sessions

[table id=15 /]Benefits and Wellness Fairs

[table id=18 /]Plan Changes for Plan Year 2019

Healthcare Plans

- All plans – premiums will increase between 1-5% depending on plan enrollment and coverage tier.

- All employees are required to re-certify their tobacco status.

Comprehensive Care plan

- An increase to the in–network and out-of-network deductibles:

- Employee coverage:

- In-Network from $500 to $750

- Out-of-Network from $1,500 to $2,250

- Family coverage:

- In-Network from $1,500 to $2,250

- Out-of-Network from $4,500 to $6,750

- Employee coverage:

- An increase to the in-network and out-of-network annual out-of-pocket maximums:

- Employee coverage:

- In-Network from $1,500 to $1,750

- Out-of-Network from $3,750 to $5,250

- Family coverage:

- In-Network from $3,000 to $3,500

- Out-of-Network from $7,500 to $10,500

- Employee coverage:

- Increase to the pharmacy copays:

- Generic – from $10 to $15

- Preferred – from $35 to $40

- Non-Preferred Brand – 20% with $50 (previously $45) min and $130 (previously $125) max

Consumer Choice HSA plan

- An increase to the in–network and out-of-network deductibles:

- Employee coverage:

- In-Network from $2,000 to $2,200

- Out-of-Network from $4,000 to $4,400

- Family coverage:

- In-Network from $4,000 to $4,400

- Out-of-Network from $8,000 to $8,800

- Employee coverage:

- An increase to the in-network and out-of-network annual out-of-pocket maximums:

- Employee coverage:

- In-Network from $3,500 to $3,700

- Out-of-Network from $7,000 to $7,400

- Family coverage:

- In-Network from $7,000 to $7,400

- Out-of-Network from $14,000 to $14,800

- Employee coverage:

BlueChoice HMO plan

- An increase to following copays:

- Physician’s Office Visit from $30 to $35

- Specialist Office Visit from $60 to $70

- Outpatient Hospital Services from $200 to $250

- Urgent Care from $60 to $70

- Increase to the pharmacy copays:

- Generic – from $10 to $15

- Preferred – from $35 to $40

- Non-Preferred Brand – 20% with $50 (previously $45) min and $130 (previously $125) max

Castlight

- Ends on December 31, 2018.

Well-being Incentive

- Employees and spouses who are enrolled in a USG health plan can earn up to $100 well-being credit by completing health activities between January 1 and September 30, 2019.

Dental Plan – Delta Dental

- No changes to plan benefits or premiums.

Vision Plan – EyeMed

- No changes to plan benefits or premiums.

Life Plans – Securian Financial (name changed from Minnesota Life)

- No changes to the plan benefits or premiums (unless you change age brackets).

Supplemental Life

- Employees will be allowed to increase 1x salary up to the lesser of 3x salary of $500,000 without Evidence of Insurability (EOI).

Spouse Life

- All increases or new enrollees will require EOI.

Short and Long Term Disability – MetLife

- No changes to the plan benefits or premiums.

Flexible Spending Accounts and Health Savings Accounts – Optum

- No changes to the plan benefits or account fees.

- Health Savings Account (HSA) annual contribution limit increase:

- Individual from $3,450 to $3,500

- Family from $6,900 to $7,000

- The HSA match will remain the same in 2019 with a maximum match limit of $375 for individual or $750 for family coverage.

LifeStyle Benefits – LifePerx

- All packages will now cover family members.

- Increase of $3.00 per package in 2019.

Accident plan – Voya

- No changes to plan benefits and premiums.

Critical Illness plan – Aflac

- No changes to plan benefits and premiums.

Hospital Indemnity plan – Voya

- No changes to plan benefits and premiums.

Legal plan – LegalEASE

- No changes to plan benefits and premiums.

Shared Sick Leave

- Employees may elect to enroll in the Shared Sick Leave program during Open Enrollment. An employee who elects to enroll must donate at least 8 hours to enroll.

Whom Do I Contact With AU Benefits Questions?

Augusta University employees may contact the OneUSG Connect – Benefits Call Center at 1-844-5-USGBEN (1-844-587-4236) or the AU Benefits and Data Management Office at 706-721-3770.

Augusta University

Augusta University